Navigating the complex labour laws governing employment practices is essential when running Kenya payroll. However, building an in-house compliance team may not be the most efficient way to manage your remote team’s payroll in Kenya.

Regardless of size, global companies need help to secure in-country expertise for localised payroll service. This is where a partner like Workforce Africa provides significant value in supporting global firms to maintain compliance when handling payroll in Kenya, addressing every intricate detail, including;

- Salary computation requirements,

- Taxation legislation specifics (social security, employee income tax, corporate tax, VAT and other employee deductions.

- Benefits administration, and more (health insurance, pension, paid leaves, holiday compensation

Workforce Africa simplifies hiring and payroll compliance for offshore talent management in Kenya. No need for a subsidiary or entity setup. From contracts and onboarding to taxes, payroll, and admin tasks, partnering with us – a payroll firm in Kenya will help you focus on growth for greater levels of success.

Kenya Country Overview

The Republic of Kenya lies in East Africa. It is predominantly an English-speaking country. Two major cities in Kenya are Nairobi, the capital and economic hub, and Mombasa. These urban centres act as transit points to ecotourism destinations and beach resorts. With a population exceeding 56.10 million people, Kenya boasts a significant demographic presence.

In recent years, key industries experiencing growth include petroleum production, cement, and textile. Kenya boasts a market-based, diversified economy comprising oil and gas, timber, tobacco, iron, steel products, and services. Considerations such as the low labour cost and abundant natural resources make Kenya attractive for businesses seeking expansion opportunities.

Although Kenya possesses a highly skilled workforce, hiring and establishing a team can be time-consuming and challenging. However, partnering with an Employer of Record (EOR) or Professional Employer Organisation (PEO) in Kenya facilitates swift market entry. It manages all legal complexities associated with operations in the country.

Payroll Processing in Kenya

Local labour laws in Kenya govern payroll processing, with each employee’s salary potentially calculated differently. Due to compliance concerns, processing payroll at scale can become complex, cumbersome, and risky. Here are the phases of payroll processes global businesses should understand:

Pre-payroll Phase

Your organisation’s unique approach to payroll compliance shapes its policies and processes, including payroll preparation. Global firms must prioritise essential business elements in the pre-payroll phase, such as accurate business profile documentation and tailored work location policies, which is crucial. Customise leave and work policies to align with local standards in Kenya to ensure compliance and transparency while collaborating closely with compliance teams or partners to help adhere to statutory requirements throughout the payroll management process for your remote team. In this phase also, standardising compensation packages to conform with local payment norms, such as payment cycles, which enhance compliance and meet employee expectations, is necessary.

Payroll Calculation Phase

Streamlining input collection and validation processes ensures accurate wage calculations in this phase of payroll processing. This phase involves the actual calculation of wages, with a primary focus on this task. Utilising software automation and digital document submission tools makes payroll calculations efficient and reduces the risk of human error in this process.

Post-payroll Phase

This stage involves sending an invoice to the bank or payment processor to initiate salary disbursement. The post-payroll phase primarily focuses on salary payments, although accounting and reporting are also vital for related purposes. Payroll accounting internally tracks all wages disbursed, representing a significant company expense. Reporting all payments and deductions to an external authority ensures compliance with regulations, as governing bodies often demand various supporting documents like tax forms related to payroll.

Payroll Components in Kenya

Ensuring compliance with local labour laws while running payroll in Kenya necessitates understanding the essential components that require careful consideration. Here are some aspects comprehensively needed to navigate Kenya’s payroll compliance:

- Salary/Wages

- Overtime benefits

- Social security contribution

- Paid leaves

- Paid holidays

- Payroll taxes

- Other laws

Navigating Kenya Payroll Compliance

Kenya’s employment regulation primarily revolves around the Kenyan Employment Act 2007, along with pertinent sections of other laws and acts.

The Labor Law outlines critical aspects of payroll processing and compliance with crucial employment practices:

a. Salary/ Minimum Wage:

The current minimum wage is KES 13,572.909.

b. Overtime Benefits:

Average working hours consist of 45 hours of work per week. The Kenyan law specifies the normal working hours, varied by industries and goes up to 52 hours for factory employees. If an employee works in excess of normal hours per week as specified, the additional hours are treated as overtime.

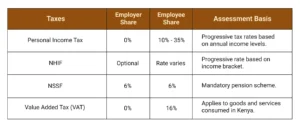

c. Social Security Contribution

- National Social Security Fund (NSSF): This scheme provides benefits like retirement pensions, withdrawal benefits, survivor’s benefits, invalidity benefits, and funeral grants. Both employers and employees contribute to the NSSF. A maximum of KES 2,160 is contributed per month, with employers matching the employee’s contribution.

d. Pension Contributions

- National Social Security Fund (NSSF): This is the primary public pension scheme in Kenya, which is mandatory for most employed people. It covers employees (both formal and informal sectors) and self-employed individuals.

- Employee: Contributes 6% of their monthly earnings, up to a maximum of KES 200 per month.

- Employer: Matches the employee’s contribution of 6%, bringing the total contribution to a maximum of KES 400 per month.

- National Hospital Insurance Fund (NHIF): This scheme helps cover medical expenses for members. Only employees contribute to the NHIF. The contribution amount varies depending on the employee’s income bracket.

e. Payroll Taxes

Paid Leaves

- Annual Leave: Employees accrue at least 21 consecutive days of paid annual leave after every 12 months of continuous service. Leave accrues at a rate of 1.75 days per month worked. Employees can take their leave days all at once or, with employer agreement, spread them out throughout the year.

- Sick Leave: Employees are entitled to 14 days of paid sick leave per year after two months of employment. For the first seven days, employees receive full pay. The remaining seven days are paid at 50% of their regular wages.

- Maternity and Paternity Leave: Maternity leave is not explicitly mandated by law, but some employers may offer it as part of their benefits package

In Kenya, employees can be granted compassionate/ special leaves on some family events. Such leave shall be paid within the limits and deadlines specified.

Paid Public Holidays

In Kenya, the paid holidays are as follows:

- New Year’s Day: January 1

- Good Friday: The Friday before Easter

- Easter Monday: The Monday after Easter

- Workers’ day: May 1

- Eid al-Fitr: date varies

- Eid al-Malud: date varies

- Eid al-Adha: date varies

- Madaraka Day: June 1

- Jamhuri Day (Independence Day): December 12

- Christmas day: December 25

- Boxing day: December 26

Payroll in Kenya also encompasses termination and probationary periods law. Probation periods cannot exceed six months initially, this can be extended for another six months, with the employee’s agreement, for total maximum of one year. During probation, either the employer or employee can terminate the contract with seven days’ written notice. The employer can also opt to pay the employee seven days’ wages in lieu of notice.

Payroll Outsourcing in Kenya

Payroll outsourcing in Kenya primarily helps global companies in the country file tax returns on time, ease the pressure of work, reduce the burden of processing payment for their workforce in Africa with 100% accuracy and within timelines – Companies want to avoid errors in employee salaries, as salary is one of the critical reasons for attrition.

Collaborate with an Africa employer of record and payroll solutions provider such as Workforce Africa to strategically outsource your payroll operations while ensuring compliance with local labour regulations. Additionally, leverage our flexible service offerings to expand your international teams as needed.